Fund managers and advisors – more than meets the eye.

It’s a bit of a paradox. The more seamless and effortless an end result may seem, the more preparation and training it takes to achieve.

Just like when you visit the classroom of an excellent teacher, you see the students are interested and engaged. What you don’t see is the hours and hours of preparation that a teacher put in beforehand.

It’s the same with investment professionals. Their objective is to help you achieve your financial goals. You see the end result, not the years of training and experience, or weeks of analysis and consideration spent understanding and assessing your needs and ensuring your investments will meet them.

It pays to understand the people on your investment team.

As an investor, it’s important that you know what the professionals who are involved with your portfolio bring to the table. For two basic reasons:

- the success of your portfolio is impacted by their expertise; and

- you are being charged fund management and dealer fees.

Know the players and what they do.

Mutual Fund Dealers, Investment Dealers, Investment Fund Managers and Portfolio Managers have all received specialized training in the investment field and belong to and follow the self-regulatory organizations. They have different roles in respect to your portfolio.

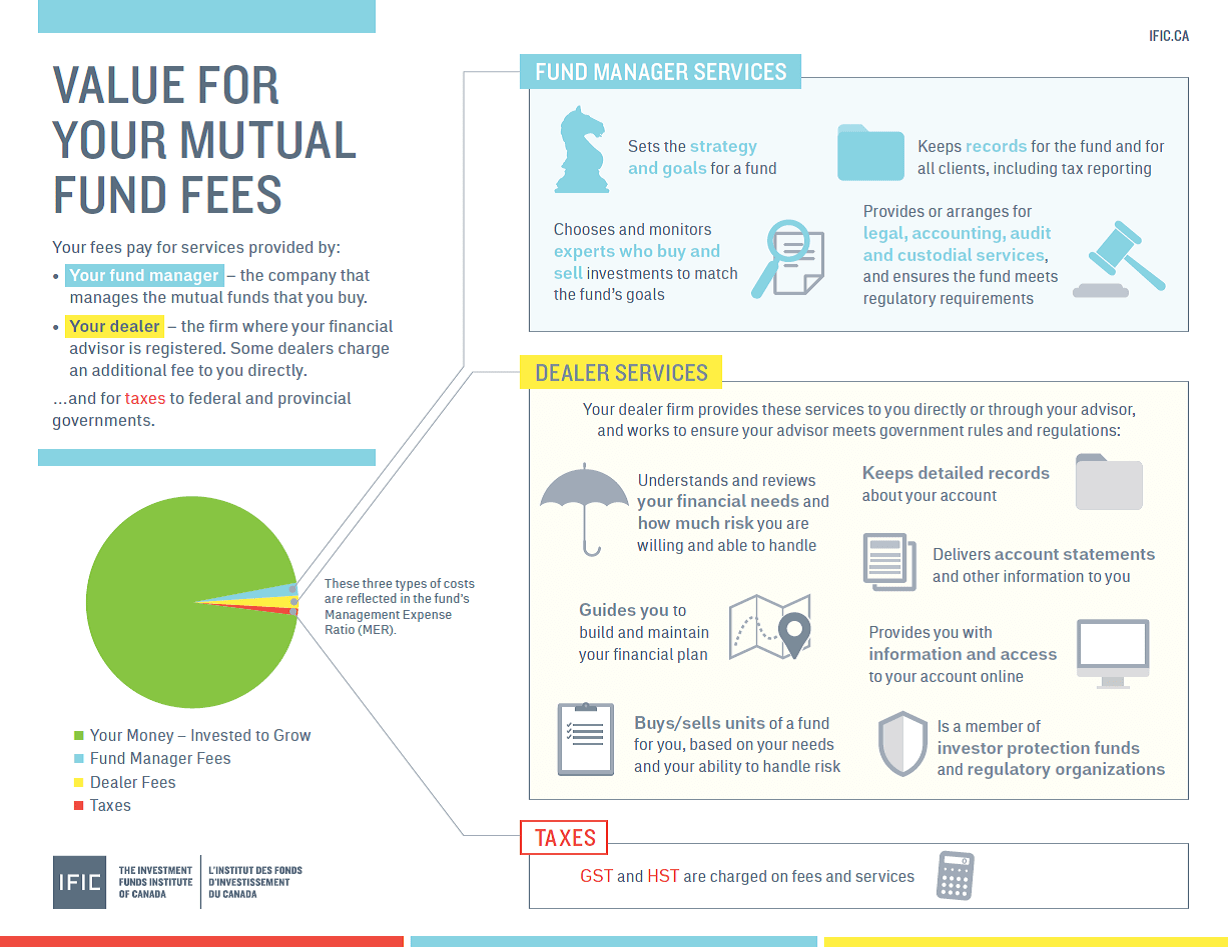

Mutual Fund Dealers understand and review the client’s financial needs and risk tolerance, guide the client to build and maintain a financial plan, buy or sell units of a fund for the client, keep detailed records of the client’s account, and provide information to the client. Dealers also have responsibilities as members of investor protection funds and regulatory organizations such as the Canadian Investment Regulatory Organization (CIRO).

Investment Dealers are also required to be members of the CIRO, which sets regulatory standards, confirms members meet licensing education and qualification standards, audits members, investigates complaints, and takes enforcement action.

Investment Fund Managers set the strategy and goals of a fund, choose and monitor the experts who buy and sell investments to reach the fund’s goals, and keep detailed records for the fund and for clients, including tax reporting. In Ontario, Investment Fund Managers are regulated by the Ontario Securities Commission (OSC).

Portfolio Managers are assigned by fund managers to manage the investments within the fund, and must be registered with securities commissions. Registry demands the meeting of specific educational and experience requirements.

The infographic below from the Investment Funds Institute of Canada summarizes how the roles differ, and the kind of work each does behind the scenes, which you may not see but which enables these professionals to deliver on their commitment to helping their clients.

Understanding the fees you’re charged.

As a result of regulatory changes to investment reporting, as of January 2017 you will receive an annual report on charges and other compensation. It will show in dollars the amount that the dealer or advisor was paid for the products and services provided.

Your Educators Financial Group financial advisor would be pleased to answer any questions you may have on your report or the fees you are charged.

When it comes to advice, think of value, not price.

When it comes to understanding the value that professionals add to your portfolio, perhaps Warren Buffett summed it up best: “Price is what you pay. Value is what you get.” The fees you pay on your Educators Financial Group funds help provide you with professional expertise to help you meet your long-term investment goals. If you have questions, call us at 1.800.263.9541.