Protect your future with professional advice

(Reading time: 2:50)

You aren’t a doctor, so when your son needed an operation you talked to a pediatrician. You don’t build homes, so you hired a recommended contractor for your new family room.

Why? Because you understand that the more important the result, the more important the training and qualifications of the experts you trust to work with. So when you’re investing for your future to ensure you have the finances you and your family will need, you want to work with a professional financial advisor.

Show me the money.

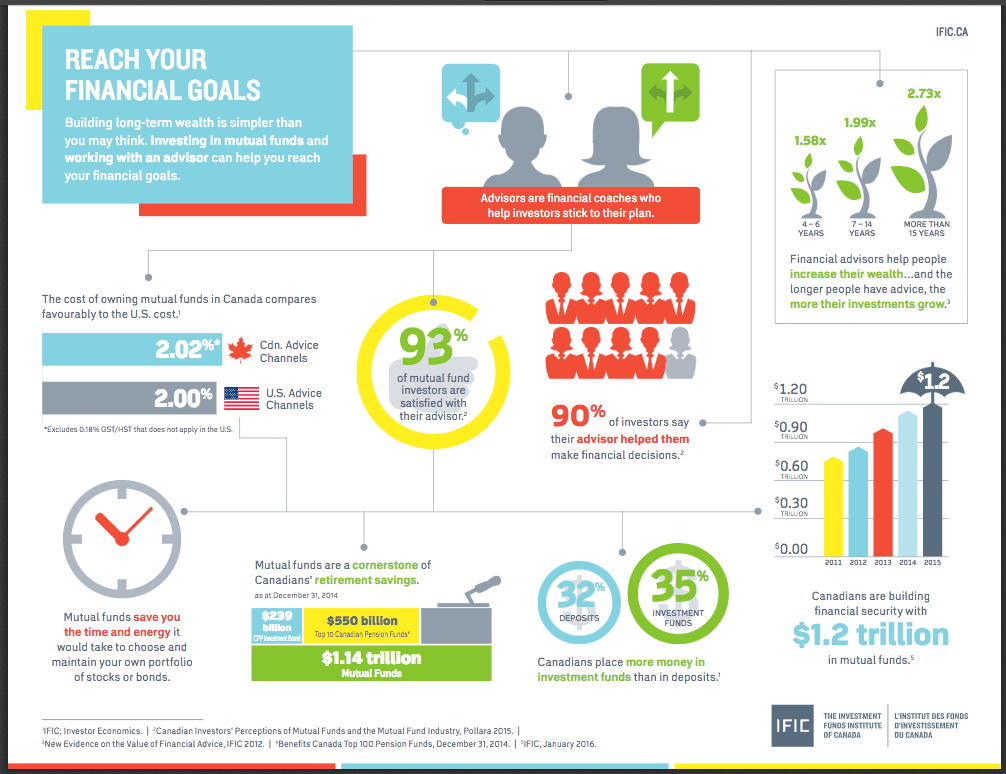

Fact is, you’ll be dollars ahead by working with an expert. This may seem like common sense, but the Investment Funds Institute of Canada (IFIC) has figures from studies that were completed in recent years to back up the claim—figures of particular interest to education members like you.

For those saving for a long retirement:

Investors who work with advisors for 15 years or more accumulate 3.9 times more in savings than comparable investors without advice. Isn’t this good news for education members, who typically enjoy a longer-than-average retirement?

For those who want peace of mind:

When your job means having to wonder about salary disruption, your savings are particularly important. It’s good to know that 95% of mutual fund investors trust their advisors to give them sound advice.

For those just starting out:

Investors at any level, even beginners who may not be very high on the pay grid, benefit from advice. 37% of mutual fund investors had less than $10,000 in financial assets when they first started using an advisor and 55% had less than $25,000.

The chart below includes more information on the importance of investing to Canadians and specifically, how advisors have helped them.

Our advice hits the bull’s eye.

At Educators Financial Group, our Financial Advisors are highly trained, have specialized knowledge of how investments work, and know how to choose ones to suit your needs and goals. They’re also aware of, and experienced in dealing with, issues that are unique to members of the education community. We’ve been helping educators since 1975, when they didn’t have anywhere to turn to for educator-specific mortgages, financial advice or planning.

We can provide practical, experienced, and knowledgeable help with issues such as:

- Your long-term savings may need to stretch further, for a longer-than-average retirement.

- Your RRSP and your pension have to work together to supplement your retirement income, while minimizing the taxes you pay.

- You need an emergency fund, for unexpected situations such as a salary disruption.

- Cash flow is critical for you, for the summer time, or for your 4 over 5.

“The ideal scenario is when your financial advisor knows investments, knows the financial challenges faced by people in your field of work, and knows you and your goals. And that’s exactly what Educators offers our clients,” says Ed Gougeon, Educators Senior Financial Advisor.

Our focus = your advantage.

Like most investors, you probably do some occasional online research, and may talk about the ups and downs of the market with your colleagues at lunch (in between making photocopies, returning messages, and eating your sandwich). But you don’t have time to be aware of and understand changes to requirements that could affect how you invest. Your Educators Financial Advisor does that for you. Because investments and financial planning are their sole focus, they’re up-to-date on new regulations, will ensure your portfolio reflects them, and are available to discuss them with you at any time. Recent changes now require that you receive “Fund Facts”, which provide key facts about a mutual fund before it is purchased, and the introduction of new investment reports which make your investments easier to understand.

When it’s hard to find the time, we make it easier.

Your time and convenience are important. That’s why our financial advisors come to you, and not the other way around. You should know that, in addition to investment advice and products, Educators Financial Group can help you with a wide variety of financial issues.

From setting up your first budget to getting a pre-approved mortgage, from establishing an emergency fund to investing in mutual funds, Educators can save you time and effort by being your one-stop source of trusted financial advice and products, geared to the needs of the education community. Make sure you get advice from those who know you best.

Educators Financial Group can help. Speak with us today.

For more information on the value of advice, read these articles in The Learning Centre: