The impact of the 2018 U.S. midterm elections

It’s fair to say that the U.S. midterm elections on November 6th garnered more attention than midterms have had in several years. In fact, voter turnout was expected to be higher than usual.

To recap, during the midterms 435 seats in the House of Representatives were up for grabs, and the Democrats needed just 23 in order to control the house for the first time in 8 years. In the Senate, 35 seats were up for grabs, and the Democrats needed to win 2 to get control. In addition, 36 Governor seats are being elected.

Leading up to November 6th, the prediction was that the Democratic Party would take back control of the House of Representatives while the Republican Party would retain control of the Senate.

How the results of the US midterm elections will affect the markets

According to Certified Financial Planner professional Robert Johnston, markets historically do well after U.S. midterm elections: “So far, the market is hawkish. Historically, after U.S. midterms the market goes up (no matter which party wins the midterm election). Since 1946, we have had 18 midterm elections, and each time the market went up.”

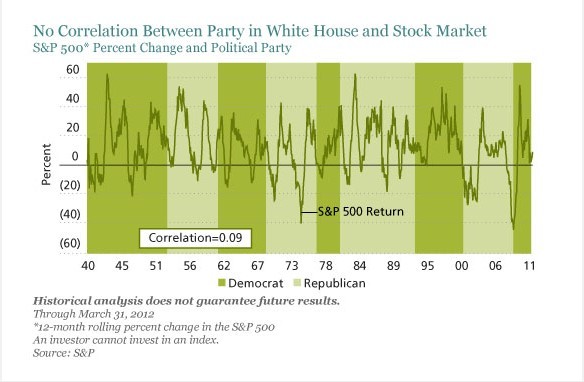

The party that controls the U.S. Congress certainly influences important fiscal and regulatory policy decisions, and can affect certain parts of the equity market. But whether the party leadership of Congress drives long-term investment returns is debatable. In fact, the chart below shows that party control of the White House has had no correlation with stock market performance between 1940 and 2011.

Source: https://blog.alliancebernstein.com/post/en/2012/10/do-the-us-elections-matter-for-investors

The results: Democrats take control of the House of Representatives.

With Tuesday’s results of the Democrats regaining control of the House of Representatives and the Republican Party maintaining control of the Senate, a period of gridlock would likely ensue. Generally speaking, the U.S. equity market has done well in periods of gridlock, which minimizes the chance of significant legislation being passed until 2020 and the next presidential election. With the U.S. economy and the equity market in good shape, markets would likely respond well to this result.

Possible impact on Canada

Some of the results of the U.S. House of Representatives being under Democratic control could include*:

- Another budget impasse, which could mean uncertainty for Canadian suppliers

- Possible impact on the U.S.-Mexico-Canada trade agreement (USMCA). Whether the deal is ratified, how quickly it is ratified, and whether it will need to be tweaked, will all be a negotiation between the 116th Congress and the Trump White House.

- Backlash against Canadian oil and gas projects (such as the oilsands and pipelines such as Keystone) by a Democratic House.

- Potential defusing of the U.S.’s growing trade conflict with China (called by the Bank of Canada’s governor Stephen Poloz as one of the biggest risks to the Canadian economy).

*https://www.cbc.ca/news/business/midterms-canada-economy-1.4884401

Educators’ financial specialists can help with your investment questions.

For most of us, our investment choices have been made with our eyes on a long-term goal, so we should be careful about reacting to relatively short-term circumstances—such as the political climate in the U.S.

If you have questions about your portfolio and whether your investments are continuing to satisfy your needs, speak with your Educators Certified Financial Planner professional today.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering of tax, legal, accounting or professional advice. Please ensure to consult your accountant and/or legal advisor for specific advice related to your circumstances. Educators Financial Group will not be held responsible or liable for any losses, costs, damages or expenses incurred by reason of reliance as a result of the aforementioned information. The information presented was obtained from sources that are believed to be reliable. However, Educators Financial Group cannot guarantee their completeness or accuracy.