Mutual Funds 101: What are the risks of investing in mutual funds? How am I protected?

Risks are to investing what students are to teachers—you can’t have one without the other.

But where you might not be able to control 100% of your students, 100% of the time—with your investments, you can control the amount of risk you decide to take on throughout the course of your lifetime.

The first step is to understand how long you have to invest, so you can make informed investment decisions that reflect your individual circumstances.

For example, we know that those who are closer to retirement are usually willing to accept less risk than an education member that is just starting out in their career (and can ride out the market’s ups and downs). Knowing your goals and the timeframe you have to make those goals happen is a good guiding star when it comes to taking on the level of risk you’re comfortable with.

“Naturally all investments have some level of risk,” says Karen Hubbard, Vice President, Client Advisory Services of Educators Financial Group. “That’s why it’s important to discuss with a professional the amount of risk you are prepared to accept.”

As we mentioned in ‘How does a mutual fund make me money?’, one of the benefits of mutual funds is that their diversification reduces risk.

If one investment in the fund decreases in value; the rest may not be affected. In addition, there’s the security that comes from the fact that provincial securities commissions regulate mutual fund companies and mutual fund dealers are regulated by self-regulatory organizations such as the CIRO and AMF.

However, the fact remains that mutual funds are not like savings accounts or Guaranteed Investment Certificates (GICs). Returns are not insured or guaranteed.

The level of risk in a mutual fund depends on what it invests in. Stocks are generally riskier than bonds, so an equity fund tends to be riskier than a fixed income fund. Plus some specialty mutual funds focus on certain kinds of investments, such as emerging markets, to try to earn a higher return. These kinds of funds also tend to have a greater risk of a larger drop in value—yet the greater the risk, the greater the reward (or potential for higher returns).

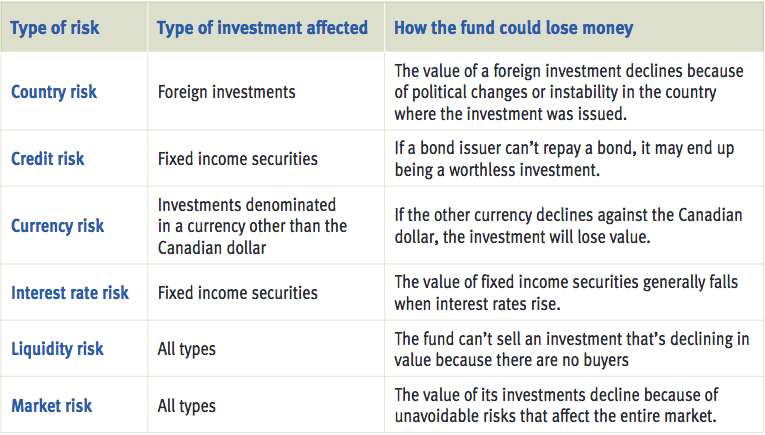

6 common types of risk when it comes to mutual funds:

How do you assess a mutual fund’s risk?

One way to assess a fund’s level of risk is to see how much its returns change from year to year. If the difference is substantial, the fund could be considered higher risk because its performance can change quickly.

Variety is important when it comes to minimizing risk.

This is where it’s good to heed the whole ‘don’t hold all your eggs in one basket’ piece of advice and minimize your overall risk by having a variety of investments in your portfolio. Before choosing a mutual fund, make sure you have a conversation with your financial advisor about how it fits your portfolio. Do you have other investments that are similar? Does it provide a balance? Does it fit your level of risk tolerance? These are all questions you should be asking yourself (and then brought up with your advisor).

Studies show that financial advisors ensure their clients are invested correctly, based on their risk tolerance.

In 2015, 76% of investors said they had a risk tolerance conversation with their advisor in the past year and 95% of investors were satisfied with their advisor’s original risk assessment*.

How your investment is protected.

Because they’re not deposits, mutual funds are not protected by the Canada Deposit Insurance Corporation (CDIC) or other deposit insurance. However, investors are protected by other safeguards: (1), a third-party custodian holds the assets of a mutual fund; and (2), an independent auditor reviews and reports on the fund’s financial statements each year.

In addition, your mutual funds may be covered by the Canadian Investor Protection Fund (CIPF) if a firm goes bankrupt:

The CIPF provides protection of up to $1 million to eligible customers of a firm that is a member of:

These investor protection funds do not cover losses from causes other than bankruptcy (such as changing market values of securities, unsuitable investments or the default of an issuer of securities) and you must file a claim within 180 days after the firm declares bankruptcy.

When it comes to risk, it’s always better to err on the better side of caution by speaking with an Educators financial advisor.

More than being highly trained investment experts, our advisors are well versed in all of the educator-specific elements that make up your financial world (such as your pay grid and pension plan). So when it comes to advice on investment risk, why risk going anywhere else?

Make an appointment to talk to an Educators financial specialist.

Click here to get the A to Z glossary of investment terms.

Check out other articles in The Learning Centre about mutual funds:

Mutual Funds 101: Your essential questions and answers.

Mutual Funds 101: How does a mutual fund make me money?

Sources:

*Pollara, 2016

http://www.osc.gov.on.ca/documents/en/Investors/res_mutual-funds_en.pdf

http://www.getsmarteraboutmoney.ca/en/managing-your-money/investing/mutual-funds-and-segregated-funds/Pages/Risks-of-mutual-funds.aspx#.V_loqdxTBBI