Is a recession due in 2019?

Newspapers have recently cited numerous predictions for a recession in 2019, perhaps because of 2018’s market volatility—traditionally, one of the predictors of a recession. However, predicting a recession is notoriously difficult, and in fact, a recession is only officially announced several months after it has started. So how does an investor know what to think?

Here’s an update on what’s being said regarding the likelihood of a recession, and what Educators investors should know.

Why a recession could occur.

Several indicators could suggest that there is cause to be vigilant. U.S. and global economic momentum seems to have peaked, and capacity constraints and a less-accommodative U.S. monetary policy are having a negative impact. “Event risks”—such as U.S.-China trade tensions—may lower consumer confidence and are already affecting international trade and investment, according to Bank of Canada (BOC) Governor Stephen Poloz.

Within Canada, Poloz lists household debt, Canadians’ ability to manage higher interest rates, and the impact of weak oil prices as issues to watch.1

Why a recession probably won’t happen.

Market volatility, although important, is just one indicator of an upcoming recession. Others include the U.S. yield curve and consumer confidence, and neither is cause for concern as of the end of December 2018. Business and consumer confidence in the U.S. were also high at year-end, despite a tightening labour pool and worsening demographics. Poloz, quoted above, also says that Canadian economic fundamentals are solid and the BOC is not expecting a recession in the upcoming year.

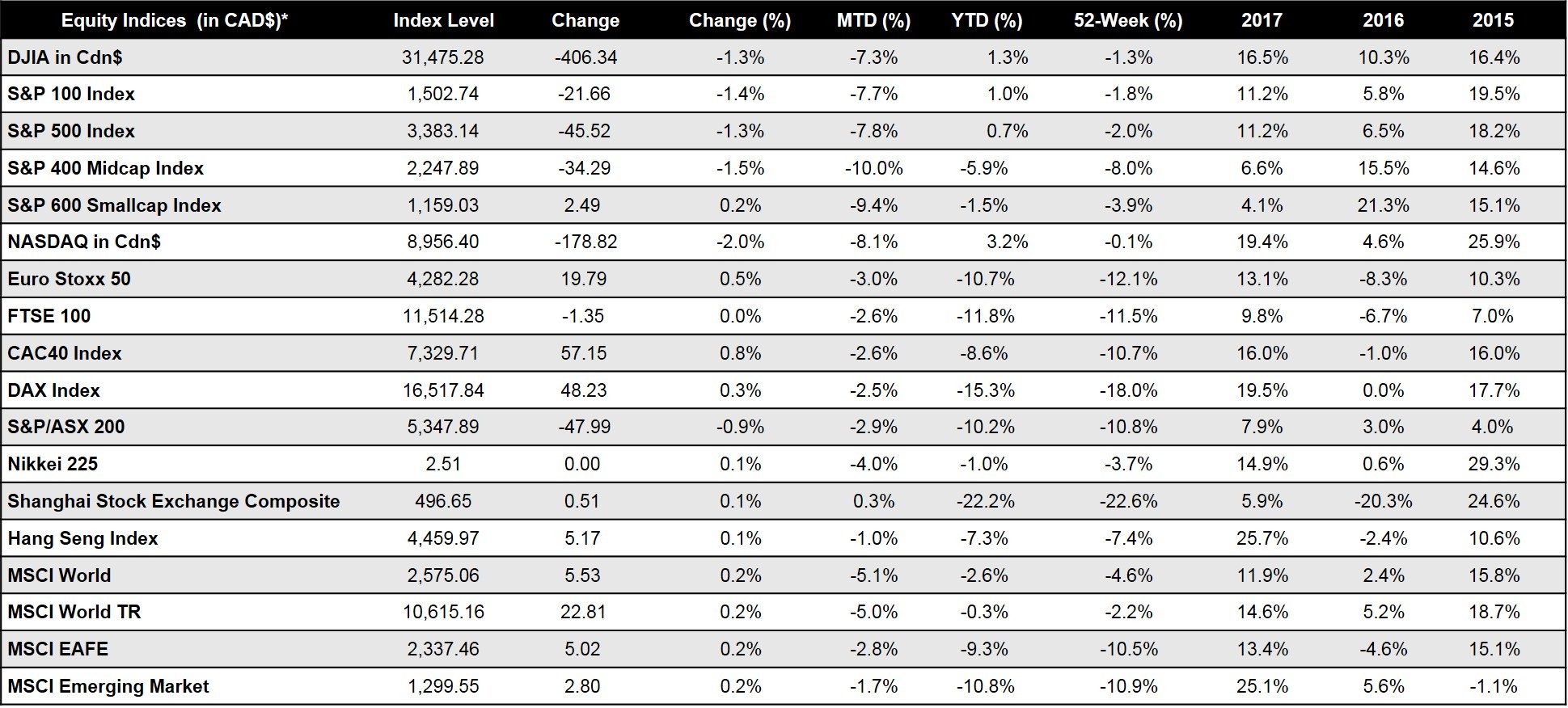

The stock market as of January 2, 2019

The first week of 2019 is a shortened one for the markets and could be affected by employment data releases later in the week. Overall, the markets are relatively benign.2

Source: Bloomberg. Returns based on simply price appreciation unless otherwise noted. Equity indices based in local currency unless otherwise noted.

MSCI indices based in USD. Equity indices in Canadian dollars are converted using Bloomberg exchange rates.

What Educators investors can do now.

“Investors need to remember the ‘big picture’, and realize that recessions are a natural part of the economic cycle,” says Educators Senior Financial Advisor Darryl Martella. “One of the best ways an investor can protect their portfolio is through proper diversification.”A diversified portfolio includes a wide range of investments, including individual stocks, bonds, mutual funds or index funds, spread against different sectors of the market. An Educators financial specialist can ensure your portfolio has the diversification it needs. The Learning Centre also has information regarding portfolio diversification, such as this article: https://educatorsfinancialgroup.ca/learning-centre/why-you-should-diversifyand-how/.

Other measures you can take to protect yourself before a recession include building an emergency fund (our financial specialists recommend saving six months’ living expenses or more), paying down debt, and reducing your fixed expenses.

For more information, speak with an Educators Certified Financial Planner professional online or by calling 1.800.263.9541.

Sources:

https://www.bnn.ca/1.1185006.1545143251

https://www.forestersassetmgmt.com/en/daily-market-commentary/20190102-new-year-begins-after-considerable-volatility

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering of tax, legal, accounting or professional advice. Please ensure to consult your accountant and/or legal advisor for specific advice related to your circumstances. Educators Financial Group will not be held responsible or liable for any losses, costs, damages or expenses incurred by reason of reliance as a result of the aforementioned information. The information presented was obtained from sources that are believed to be reliable. However, Educators Financial Group cannot guarantee their completeness or accuracy.