A financial break for first-time home buyers (and others!)

(Reading Time: 2:30)

You’ve had it with renting and landlords. Or, you’re starting a family and the one-bedroom apartment is just too small. You’re seriously looking to buy, but you’ve been adding up the costs and it sure would be nice to reduce them where you can. Education members at the beginning of their career (and others working within education such as support staff and occasional workers) are faced with this challenge often enough.

Good news! There are programs available to help cut the costs.

Part of financial literacy is knowing the resources that are available to you and how to use them.

The government and other institutions have programs to help you save.

As recently as March 2019, the federal government introduced incentives for first-time home buyers which will take effect in September 2019. This program will also be available to recently separated individuals as of January 2020.

How does this new incentive work?

The new $1.25-billion incentive program would allow prospective buyers to apply for an interest-free loan from Canada Mortgage and Housing Corporation (CMHC). That loan would then be used to lower the cost of the mortgage.

How much of an interest-free loan could eligible applicants receive?

CMHC would offer 5% towards an existing home or 10% towards a new build. To put that amount into perspective, let’s say you’re hoping to buy a $400,000 home with the minimum required 5% down payment (which is $20,000).

Under the new incentive, you could receive up to $40,000 through CMHC. This means instead of taking out a $380,000 mortgage, you’d now only need to borrow $340,000—assuming it’s a New Build. This would lower your monthly mortgage bill from over $1,970 to less than $1,750.

Further details on the CMHC interest-free loan are forthcoming.

Some of the requirements of the First-Time Home Buyers Incentive include:

- Household income must not exceed $120,000.

- Purchasers must provide a minimum 5% down payment.

- The amount of the insured mortgage is capped at 4 times the applicant’s annual income (for a maximum of $480,000 on $120K household income).

- The loan is required to be repaid.

In addition, the government is increasing the amount first-time home buyers can withdraw from their RRSPs in order to finance their purchase (the RRSP Home Buyers’ Plan) from $25,000 to $35,000 per individual.

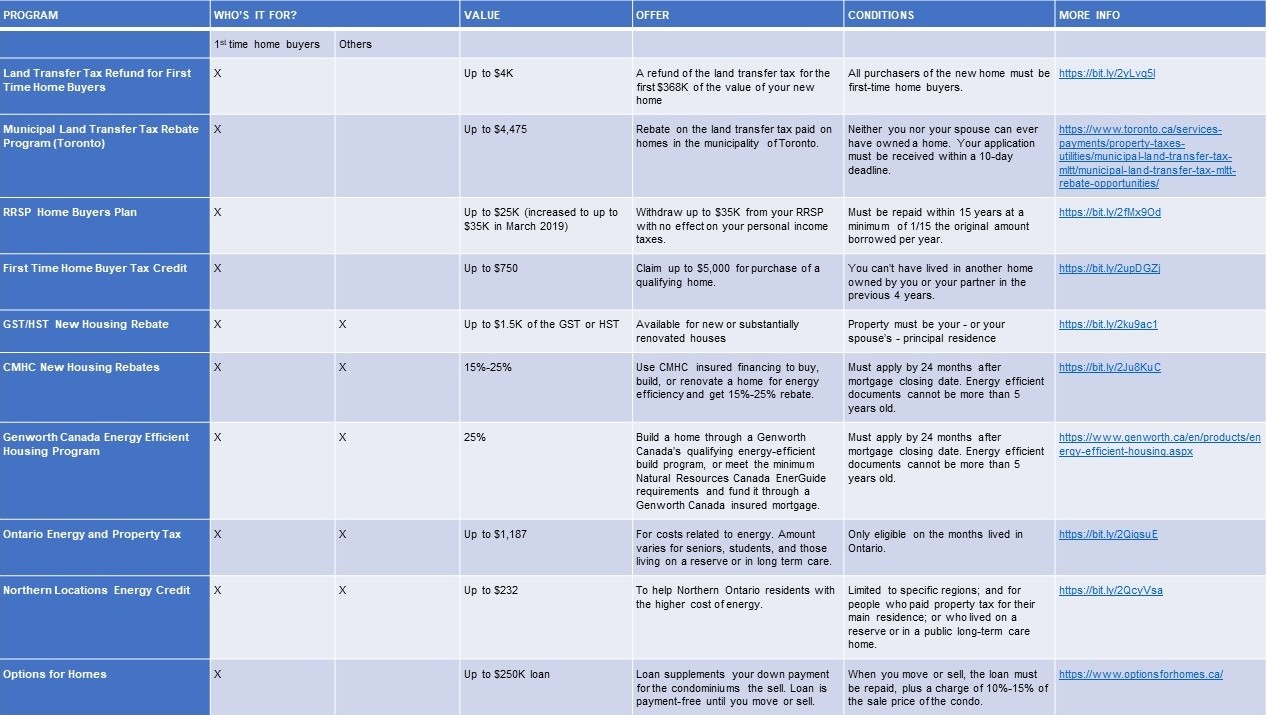

We’ve compiled a list of other ways you can save when buying a home.

To help with your busy schedule (and save you the hassle of doing even more research), we’ve pulled together a list of the potential savings, how you qualify, and where to get more information below.

Buying a home takes some of the most complicated financial planning you’ll ever have to do. Saving for a down payment, finding a mortgage that works for you, setting up a budget for household maintenance… it can all be a little intimidating for a first-time home buyer. Thankfully, experienced professionals are available to help.

An Educators lending specialist can answer your questions about buying a home.

Educators Financial Group was established over 45 years ago to help education members get the mortgages they needed. Today, our Accredited Mortgage Professionals help education members with all their questions about buying a home and finding lending solutions.

Got a question about home ownership? Call on Educators Financial Group today at 1.800.263.9541 or online.

Take a look at special programs designed for specific areas in Ontario

If you’re a first-time buyer looking for a home in one of the areas below, take a look at the program available for you where you live. Many of the programs offer forgivable loans. The amount of the loan, the value of the house, and some other details will vary… and they’re worth a look.

Region of Waterloo: https://www.regionofwaterloo.ca/en/living-here/funding-to-help-buy-a-home.aspx

Windsor & Essex County: https://www.citywindsor.ca/Pages/Home.aspx

Simcoe County: https://www.simcoe.ca/dpt/sh/apply-for-the-homeownership-program

Lambton County: https://www.lambtononline.ca/home/residents/housingservices/Pages/HomeownershipProgram.aspx

Peel: https://www.peelregion.ca/housing/home-in-peel/apply/qualifications.htm

Muskoka: https://www.muskoka.on.ca/en/community-and-social-services/gateway-muskoka.aspx

Lanark County: http://www.lanarkcounty.ca/Page1925.aspx

Dufferin County: https://www.dufferincounty.ca/residents/housing-programs-and-services#Home%20Ownership%20Program

Brokerage license 12185

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering of tax, legal, accounting or professional advice. Please ensure to consult your accountant and/or legal advisor for specific advice related to your circumstances. Educators Financial Group will not be held responsible or liable for any losses, costs, damages or expenses incurred by reason of reliance as a result of the aforementioned information. The information presented was obtained from sources that are believed to be reliable. However, Educators Financial Group cannot guarantee their completeness or accuracy.