Mortgage insurance rates are going up. Here’s what you should know.

Buying a home with less than 20% down? Education members should work with a mortgage professional to understand all the costs.

The Canada Mortgage and Housing Corporation (CMHC) has announced that mortgage insurance rates are going up as of March 17, 2017. “The actual increase may not be that much – say, $5 more a month on a CMHC-insured loan of $245,000* – but it’s something educators should be aware of when they’re budgeting for a home,” says Nick Rao, Mortgage Agent Level 1 – Regional Director, Lending Services.

What determines if your mortgage insurance premium will increase?

How much – or whether – your mortgage insurance premium will increase will depend on the “Loan-to-Value Ratio” (LVR) on your home. The LVR is a tool that lenders use to evaluate the risk in a loan. The ratio is equal to the amount of mortgage you have, divided by the property’s approved value. For example, if you have a mortgage of $200,000 on a home with an assessed value of $250,000, your LVR would be 80%.

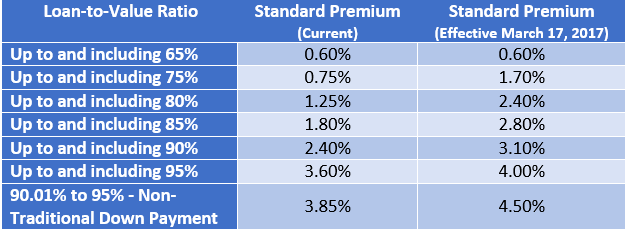

Below is the CMHC’s chart, showing how standard premiums will increase as of March 17, 2017**:

For more information on “Loan-to-Value Ratios”, take a look at this article on Investopedia.

Let’s look at a few examples of how monthly payments would increase for homebuyers with a down payment of between 5% and 9.99%:

| Loan Amount | Increase to Monthly Mortgage Payment |

| $150,000 | $2.82 |

| $250,000 | $4.70 |

| $350,000 | $6.59 |

| $550,000 | $10.35 |

| $850,000 | $15.98 |

Based on a 5 year term at 2.94% and a 25 year amortization

What’s causing the increase?

The increase is a result of an effort to control the hot housing market. On January 1, 2017, the Office of the Superintendent of Financial Institutions (OSFI) changed their capital requirements to include a formula based on LVR, credit score, location, and other factors – all designed to offset risks in the country’s red-hot real estate market.

Click here to view a list of common mortgage and homebuying terms to help you better understand the process of buying a home.

Although the potential increase in mortgage premiums may be small, added to higher down payment requirements and qualifying interest rates, and decreased amortization periods, it’s clear that – now, more than ever – homebuyers need professional help to save for a new home and find a mortgage that meets their needs.

An Educators mortgage professional can help.

Will the slight hike in mortgage premiums affect you? Maybe…maybe not so much. Your best bet – particularly for new homebuyers – is to speak with a professional who can explain the costs involved, and who will work to get the best rates for you. According to Nick, “Preparing to buy a home can be a long path that starts with budgeting and assessing your needs, and ends with knowing what kind of mortgage is right for you. The knowledgeable and experienced professionals at Educators Financial Group can make a big difference.”

At Educators, we’ve been helping members of the education community achieve their dream of home ownership for over 40 years … so we have the knowledge and experience to help you find the home you want in today’s housing market. Contact us today.

Sources:

* https://www.thestar.com/business/2017/01/17/cmhc-to-raise-mortgage-insurance-premiums.html

** https://www.cmhc-schl.gc.ca/en/corp/nero/nere/2017/2017-01-17-0830.cfm