Good news: ‘bad news’ doesn’t mean you should bail from the market.

In fact, pulling out of the market during times of volatility could cost you a lot in potential returns.

As a member of the education community, there’s a certain level of comfort that comes from knowing what the future will bring when it comes to your finances. For example, as a pension member, you know that down the road you will have retirement income that you will be able to count on.

However, when you’re invested in a market that has seen its fair share of volatility recently, the only thing that is certain is uncertainty — and that can be scary.

Market volatility often goes hand in hand with ‘bad news’ headlines, which can create a cloud of uncertainty for investors. ‘Uncertainty’ and ‘investing’ are not exactly the best of classmates, but while it may be tempting to panic and get out when market conditions take a turn for the worse, reacting emotionally may cause you to lose sight of your long-term savings and investment strategy — and that could cost you greatly in potential returns down the road.

Educators Certified Financial Planner professional Darryl Martella consistently reminds clients to stick to their long-term objectives when markets are volatile.

“Time in the market is better than timing the market”, says Darryl. “Even with significant declines, an investor who stayed in the market over the past number of years has still had positive returns.” It’s also important to remember that if you worked with a financial advisor to create a plan that works for you, that plan was most likely designed to weather a few storms like this one.

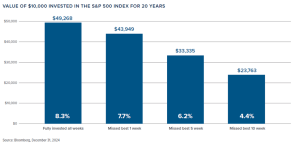

And we’re not just being positive with that statement. The chart below shows how much more your investments increase in value by staying invested over time:*

Scenario 1: You remained fully invested in S&P 500 INDEX for over 20 years, in which case your $10,000 would have grown to $49,268, or 8.3% compound annualized return.

Scenario 2: During periods of volatility/uncertainty, you pulled out of the market for the best 1 week over the 20-year period. Instead of receiving 8.3% return, your return would have diminished to 7.7%.

Scenario 3: During periods of volatility/uncertainty, you pulled out of the market for the best 5 weeks over the 20-year period. Instead of receiving 8.3% return, your return would have diminished to 6.2%.

Scenario 4: Finally, during periods of volatility/uncertainty, you pulled out of the market for the best 10 weeks over the 20-year period. Instead of receiving 8.3% return, your return would be diminished to 4.4%, a material difference of 3.9% or $25,505!

So, the lesson here is when the going gets tough—the tough don’t get going, but instead stay invested in the market.

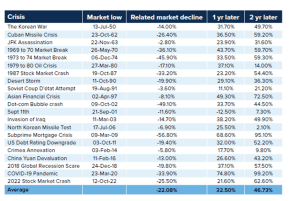

The reaction of the markets to major historical events also shows that the market rebounds.

The chart below is a snapshot in time of international events with significant negative impact since 1950 (up to 2022). It depicts how the S&P 500 Index bounced back 1 year and 2 years later.**

While the market will always be unpredictable, one thing is certain — there will be future events that will cause volatility.

So don’t stress and don’t bail. Instead, stay the course and remain focused on your overall financial goals, and you’ll reap the financial rewards for your patience and persistence in the long term.

Have you reviewed your investment portfolio lately? Have one of our financial specialists contact you for a portfolio review.

Sources:

*Bloomberg, December 31, 2024

**Morningstar Direct/Bloomberg. As of December 31, 2024. Snapshot in time of international events with significant negative impact since 1950 (up to 2022). It depicts how the S&P 500 Index bounced back 1 year and 2 years later.